Why the World’s Best Company Might Be a Risky Bet

The market’s high expectations have priced Apple for perfection. For patient investors, this tension could be a gift in disguise, revealing the true price of quality.

⸻

Company: Apple Inc.

Ticker Symbol: AAPL

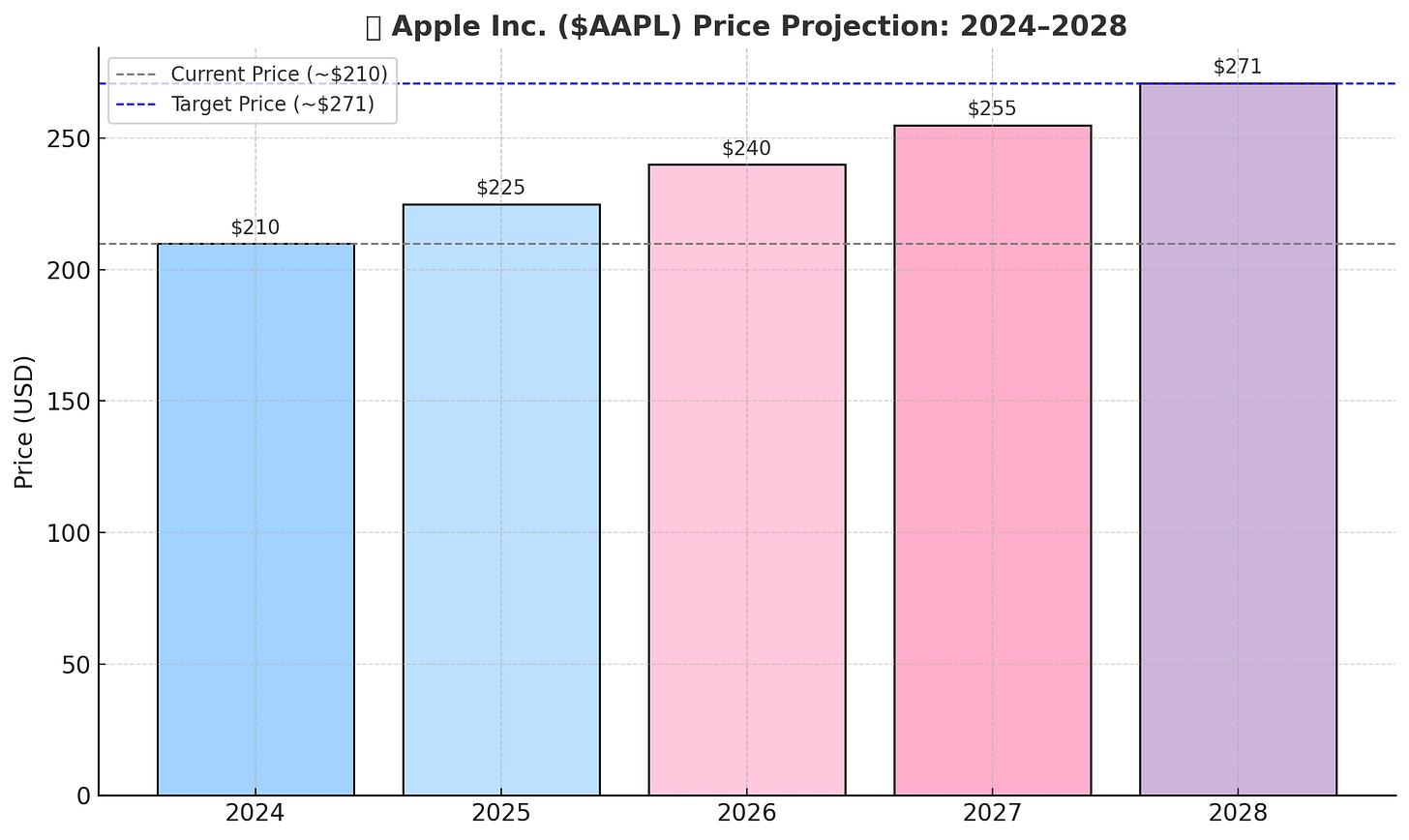

Current Price: ~$210

⸻

🏰 1. The Company & Its Moat – What am I really buying here?

The Business Model

At its heart, Apple is a design company that sells premium hardware and a deeply integrated ecosystem of high-margin services. The hardware — iPhone, Mac, Apple Watch — is the ticket to the show; the services (App Store, iCloud, Apple Music) are the concessions that generate immense, recurring profits. In FY2024, the iPhone made up over half of revenue, but Services now represent nearly a quarter — with far superior margins.

The Moat

Apple’s true moat is its ecosystem lock-in. It’s not just a brand — it’s a fortress of switching costs. Once you’re inside, moving out means losing interoperability, muscle memory, and convenience. That creates loyalty the competition dreams of.

Management & Culture

Under Tim Cook’s leadership since 2011, Apple’s market cap has 10x’d. He’s a master of supply chains and capital allocation. Apple reinvests in innovation, then returns the rest via history’s largest buyback program and a steadily rising dividend. Executives have skin in the game, and shareholder alignment is strong.

📈 2. The Story & The Strategic Levers – Why now?

Market Environment

AI is moving from the cloud to your pocket. Personal, on-device AI is the next big shift — and Apple is built for it.

Strategic Position

Apple controls the full stack: silicon (M-series, A-series), software (iOS/macOS), and services. This lets it create a secure, deeply integrated AI experience — “Apple Intelligence” — optimized from chip to UI. Competitors simply can’t match this vertical integration.

Cyclicality & Geopolitics

Apple’s reliance on China for manufacturing and sales remains its biggest vulnerability. Trade tensions or regulatory crackdowns could disrupt operations or damage brand trust. Apple is diversifying to India and Vietnam, but the shift is slow.

📊 3. The Numbers: Financial Check & Growth – How healthy is the company?

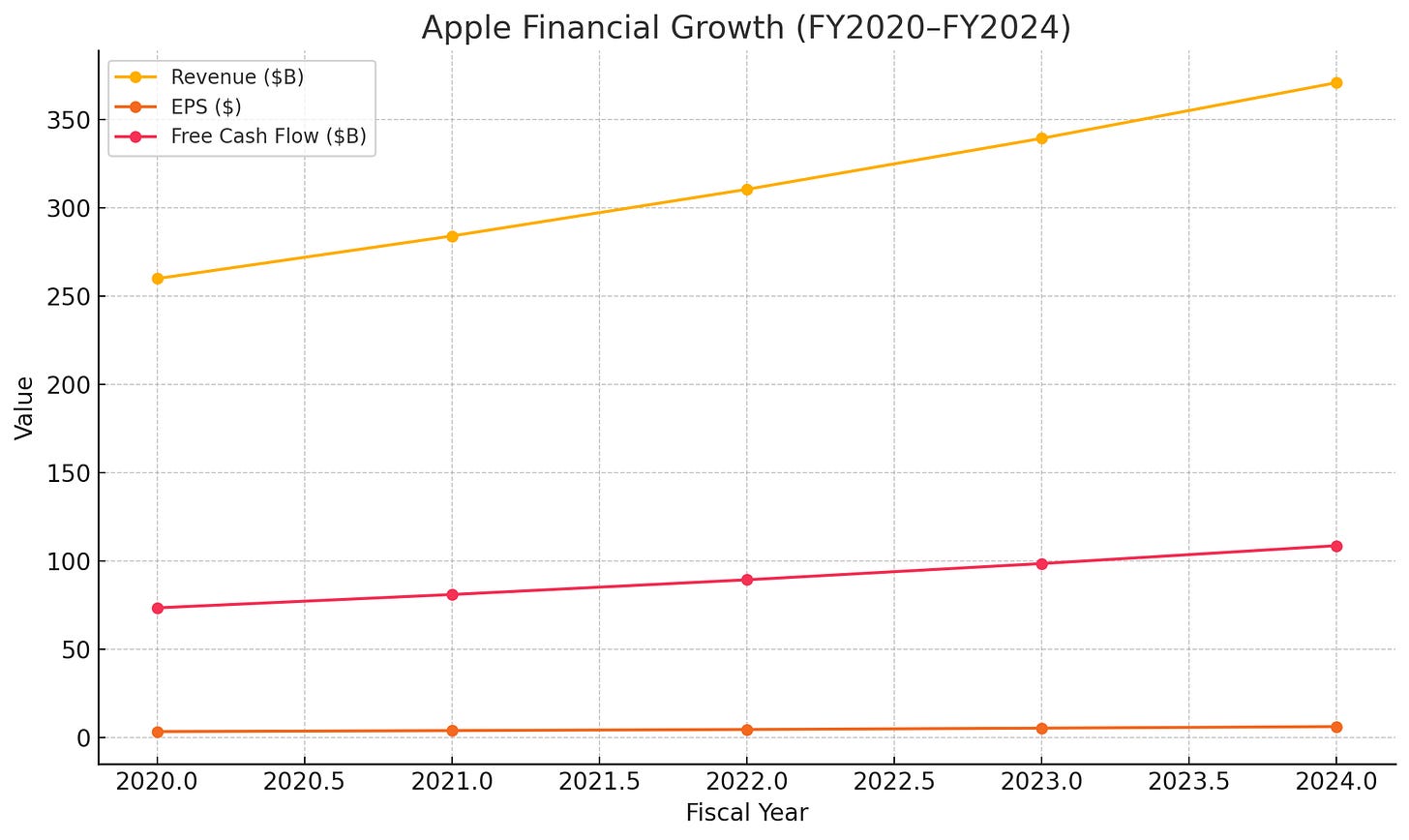

Growth History (FY2020–FY2024)

Revenue CAGR: 9.3%

EPS CAGR: 16.8%

Free Cash Flow CAGR: 10.3%

EPS is outpacing revenue thanks to aggressive buybacks, shrinking the share count and amplifying per-share earnings.

Financial Health

Operating Margin: 31.5%

Net Margin: 24.0%

ROIC: 50.3%

Net Cash Position: $45B

Apple is a cash-printing machine with fortress-like fundamentals.

Stakeholder Value

In May 2024, Apple authorized a record $110B buyback. Over the last decade, it has retired 37.8% of its shares. Dividend hikes continue, with a low 15.7% payout ratio and room to grow.

Outlook

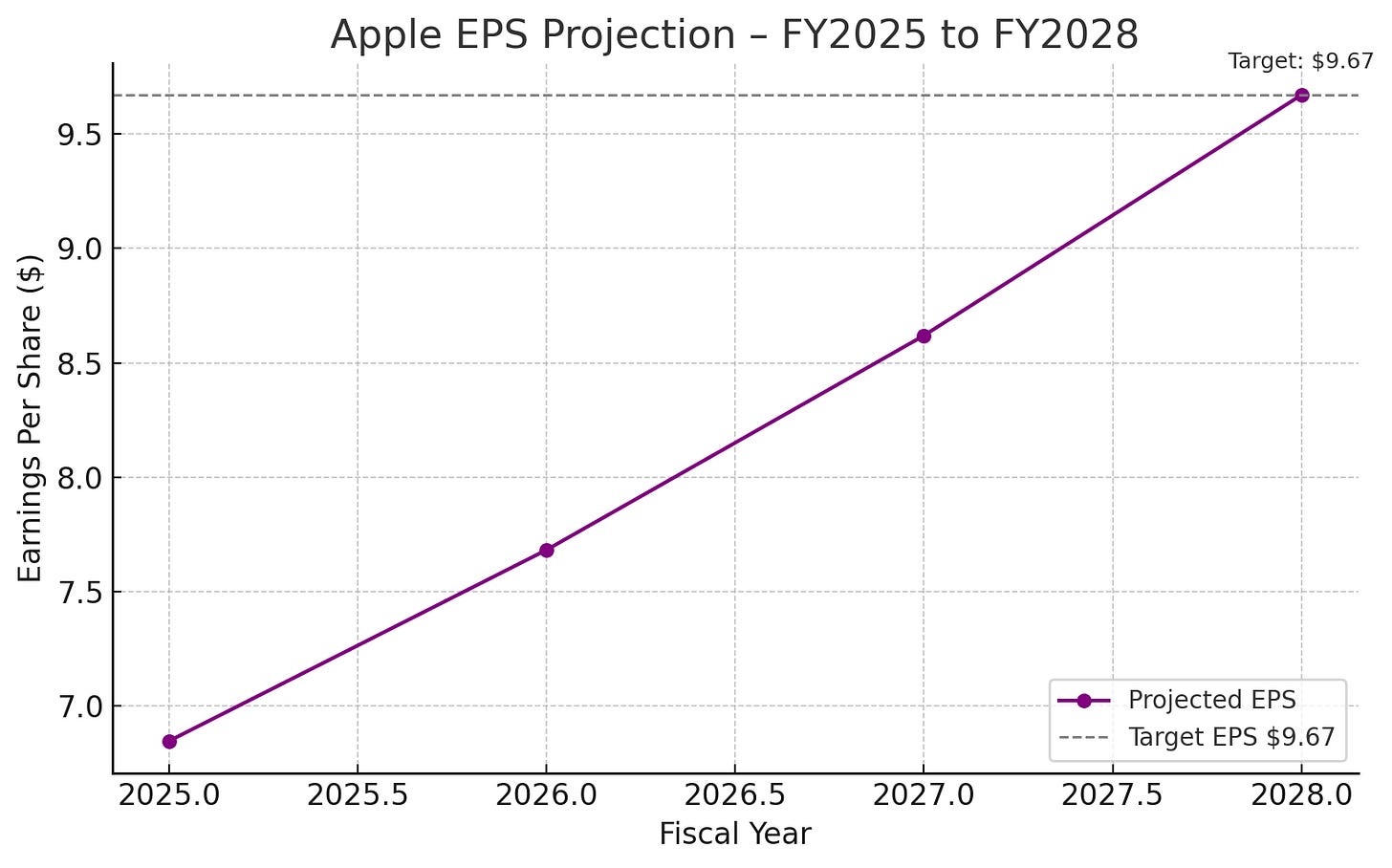

Wall Street projects 8–12% annual EPS growth over the next few years. The chart is based upon circa 11% EPS-CAGR.

💰 4. The Valuation – What is a fair price?

Valuation Check

Current P/E: 32.6x

10-Year Average P/E: 22.7x

Price/Sales: 8.0x

Price/FCF: 32.3x

Compared to peers:

$GOOGL: ~20.4x P/E

$MSFT: ~39.4x P/E

Apple trades at a premium, even relative to its own history — suggesting much of its future success is already priced in.

Price Target (FY2028 Projection)

EPS Estimate: $9.67

Fair Multiple: 28x

Target Price: $271

Upside: ~29%

Implied CAGR: ~7.5%

Margin of Safety

At ~$210, the margin of safety is minimal. If AI excitement fades or regulatory heat rises, this valuation offers little downside protection.

⚖️ 5. The Investment Thesis: Opportunities & Risks – What needs to happen?

Bull Case

AI Upgrade Cycle: Over 2.35B active devices could be pushed to upgrade for Apple Intelligence.

Services Growth: High-margin, fast-growing Services drive better profitability.

New Frontiers: Vision Pro may be a moonshot on spatial computing — not in the numbers yet.

Bear Case

Regulatory Pressure: U.S. and EU regulators are gunning for Apple’s control over its ecosystem.

China Dependency: One geopolitical shock could unravel the supply chain.

Execution Risk: If AI features flop or lag behind, the premium valuation could crumble.

🎯 6. Conclusion & Action Plan – What does this mean for my portfolio?

Apple is a world-class business with unmatched brand power, operational excellence, and shareholder-friendly leadership. But the market already knows this — and it’s priced in.

From here, the upside looks moderate and the risks very real. A 29% return over 3–4 years is solid, but not compelling enough at today’s price. We’d wait for a broader market pullback or temporary panic to buy this crown jewel at a more attractive valuation.

🌰

Hazelnuts Research – The search for quality at a fair price.

Not every price drop is a risk. Some are a gift — if you understand what you’re buying.

⚠️ Disclaimer

This content is for informational purposes only and reflects the author’s personal views and trading journal. It is not investment advice. Always do your own research. The author may hold positions in mentioned securities. Investing involves risk.

why is apple the worlds best company?