Adobe: The AI Storm and falling giant

The market has priced in a bear case, this fear might be the very catalyst for a remarkable comeback.

⸻

Company: Adobe

Ticker Symbol: ADBE

Current Price: ~$366

⸻

🏰 1. The Company & Its Moat – What am I really buying here?

When we look at Adobe, we see a business that has successfully transformed itself not once, but twice. First, by pioneering the digital creative space, and second, by making a daring pivot from selling one-time software licenses to a powerful, recurring subscription model. This move, which now accounts for roughly 95% of its revenue, fundamentally changed the company's DNA, creating a financial engine that purrs with predictable stability.

• The Business Model: Adobe’s core is a simple, elegant idea: empower creators. Its money comes primarily from subscriptions to its Creative Cloud, the digital workshop for millions of creative professionals. This is where tools like Photoshop and Illustrator live, the de facto industry standard for visual art. But Adobe’s reach extends far beyond that. Its Document Cloud, centered on the ubiquitous PDF, is a mission-critical tool for businesses of all sizes, and its Digital Experience business helps enterprises with everything from marketing to e-commerce. The entire business is a masterclass in recurring revenue, making it both robust and immensely scalable.

• The Moat: Adobe's greatest strength isn't its software; it’s the sheer weight of its ecosystem. Imagine asking a master carpenter to abandon their meticulously organized tool shed and start from scratch with a new set of tools. That's what it would feel like for a professional to leave the Adobe ecosystem. The years of muscle memory, the seamless file formats, the industry-wide collaboration—it all conspires to make a departure extraordinarily difficult. This is the company's primary defensive advantage, cemented by a massive portfolio of intellectual property. Adobe's patents are designed to create a "defensive depth" that makes it almost harder for a competitor to replicate the entire workflow experience from scratch.

• Management & Culture: We see a leader in CEO Shantanu Narayen, who has been at the helm since 2007. He’s a long-serving, visionary manager who orchestrated the bold and successful transition to the cloud. His track record suggests a disciplined approach to capital allocation and a strategic eye for acquisitions that bolster the core business. However, a skeptical investor will notice that management’s ownership of the company’s stock is remarkably low at just 0.18% of outstanding shares. While this doesn't tell the whole story, it is a point of concern for those of us who believe in aligning incentives.

📈 2. The Story & The Strategic Levers – Why now?

The Adobe story is currently defined by one central conflict: the collision of its dominant past with an uncertain, AI-powered future. The market is not questioning the company’s history; it is questioning its very ability to survive the next decade. This is where the opportunity lies for a discerning investor.

• Market Environment: The overarching trend is, of course, generative AI. This technology is a dual-edged sword, offering incredible new possibilities while simultaneously threatening to commoditize the very creative workflows Adobe has monopolized for years. This is where the opportunity lies for a discerning investor.

• Strategic Position: Adobe’s strategy is not to fight the AI revolution, but to own it. The special "lever" here is the company's ability to embed AI directly into its existing, indispensable products. Think of tools like Firefly and Acrobat AI Assistant—they are not stand-alone apps but new layers of power seamlessly integrated into Photoshop and Acrobat. This strategic position allows Adobe to sell new features, like "generative credits," to its vast and captive user base, all while reinforcing the ecosystem's value.

• Cyclicality & Geopolitics: Adobe’s subscription-based model provides a high degree of predictability, making the business far less susceptible to economic cycles than traditional software companies. While an economic downturn could slightly reduce corporate spending on creative tools, the effect would be cushioned by the long-term contracts already in place. On the geopolitical front, the recent, failed acquisition of Figma demonstrates that regulatory scrutiny can be a significant hurdle for an M&A-driven growth strategy - otherwise no big geopolitical exposure.

📊 3. The Numbers: Financial Check & Growth – How healthy is the company?

The qualitative story of Adobe’s dominance is powerfully confirmed by its financial health, which reveals a business that is not just successful, but profoundly efficient.

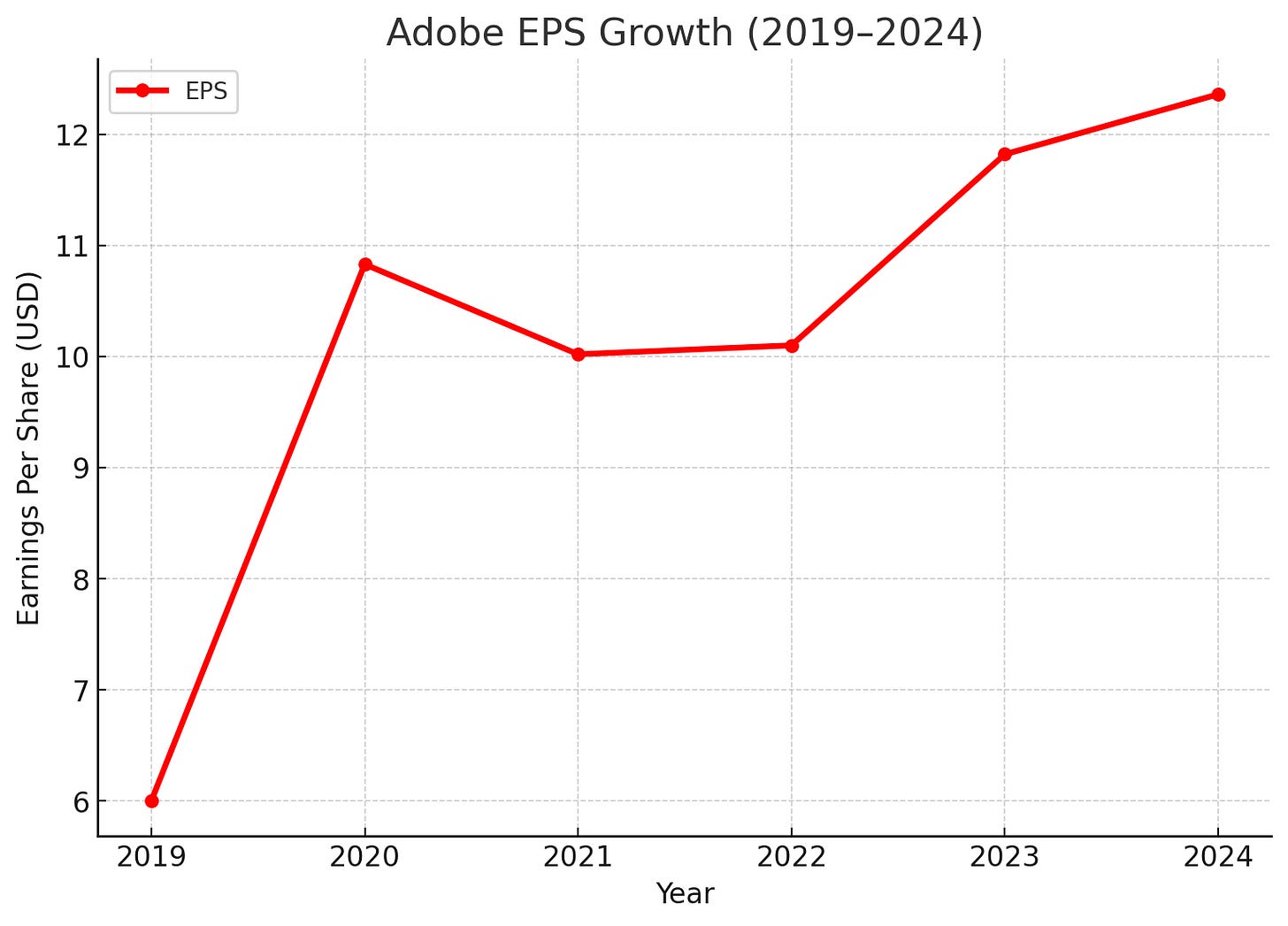

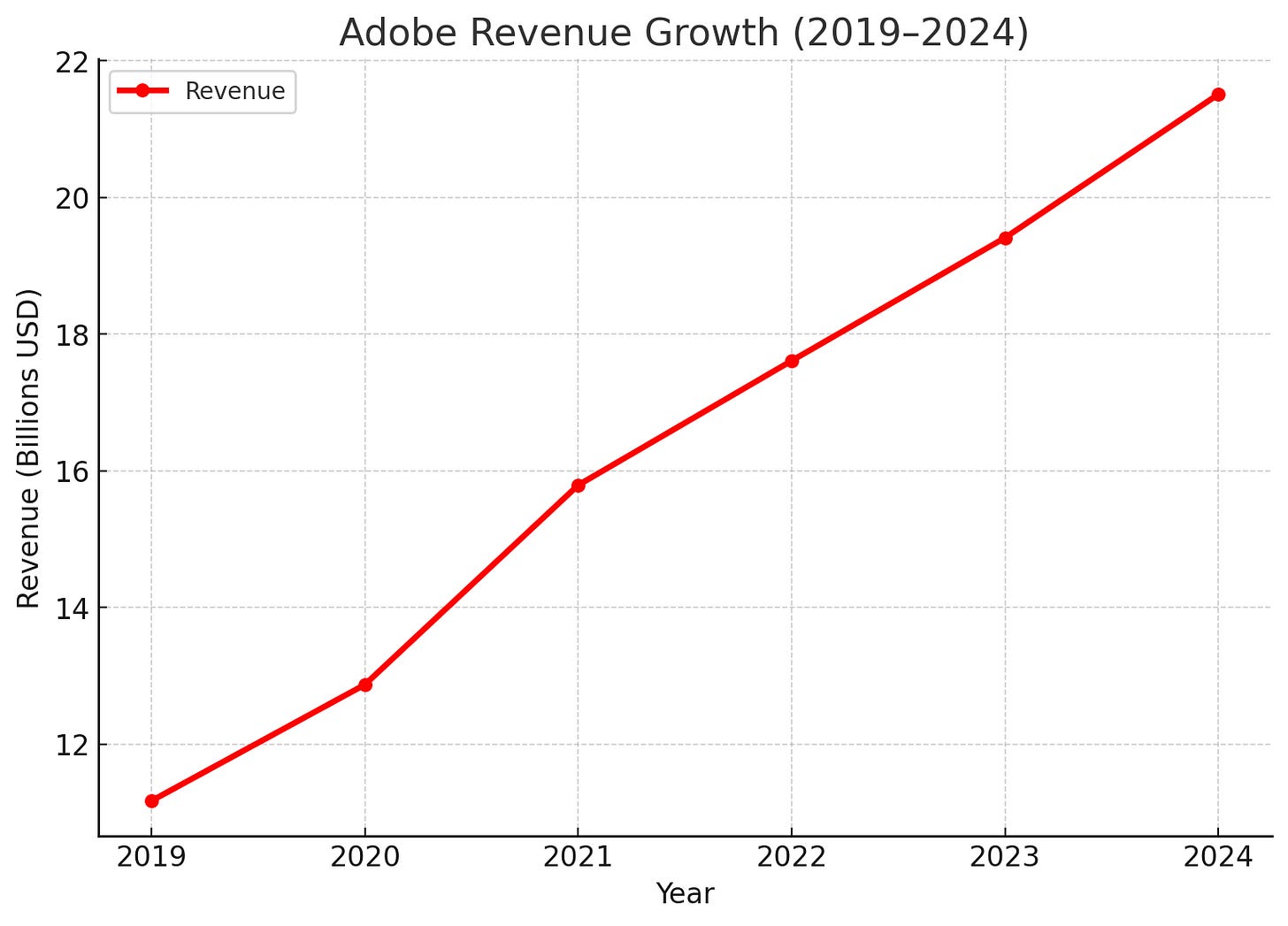

• Growth History: For a business of its scale, Adobe’s growth has been consistently impressive. Over the last five years, revenue has grown at a respectable ~15% CAGR, while both EPS and free cash flow have outpaced that at around 19-20% per year. This is the signature of a company that is not just growing, but doing so with increasing profitability.

• Financial Health: The company's margins are truly a sight to behold. Its gross margin hovers around 89%, a testament to its powerful pricing. More importantly, its ability to generate profits on capital is exceptional. We see a return on invested capital (ROIC) of 25.4% and a return on equity (ROE) of over 51%.

For a business that is so good at turning every dollar of capital into a significant profit, we’re left with little doubt about its quality. The balance sheet is also a fortress, with virtually no net debt and ample liquidity to weather any storm.

• Stakeholder Value: Adobe does not pay a dividend, a common practice for high-growth tech companies that believe they can generate a higher return by reinvesting every dollar back into the business. Instead, management returns capital to shareholders through an active share repurchase program. The strategy is clear: grow the underlying value of the business, and allow the stock price to follow.

• Outlook: The consensus from analysts is cautious but optimistic. They forecast that revenue will continue to grow at a steady rate of 8-9% annually for the next few years, with earnings per share growing slightly faster at 11-12%. This outlook, while a deceleration from historical levels, suggests a stable business that is still expanding.

💰 4. The Valuation – What is a fair price?

This is where the story gets interesting, and where the skeptical investor finds their opportunity. The market has taken a deeply pessimistic view of Adobe’s future, creating a valuation disconnect that simply cannot be ignored.

• Valuation Check: The current price-to-earnings (P/E) ratio sits around 23x-26x, which is a remarkable 50% discount to its 10-year historical average of 47.8x. It is also significantly cheaper than its peer group average of 66.4x. This is not a random occurrence. The market is screaming its concern about the risks of AI disruption and the slowing growth we noted above. To us, this is not a red flag; it is a gift. The market is offering a chance to buy a high-quality company at a price that reflects deep-seated fear, not fundamental weakness.

• Price Target Calculation: Let’s be conservative. If we assume EPS grows at just 10% annually—well below its historical average and right at the low end of analyst expectations—it would reach around $21.49 in four years. If the market then re-rates the company to a still-conservative P/E of 30x, the resulting price target is $644.70. This implies a significant upside of 75% from today’s price, which translates to a compound annual growth rate (CAGR) of over 15%. This is a powerful return for a company of Adobe’s caliber.

• Margin of Safety: The current price offers a meaningful buffer against the risks we’ve discussed. Based on an intrinsic value estimate of ~$485 per share, Adobe is trading at a notable discount. This built-in margin of safety suggests that even if the company's growth is slower than expected or if the market remains stubbornly pessimistic, the downside is limited while the upside remains substantial.

⚖️ 5. The Investment Thesis: Opportunities & Risks – What needs to happen?

• The Bull Case: What needs to happen is simple: Adobe must execute its AI strategy.

1. The company successfully integrates and monetizes its AI tools like Firefly, turning a market threat into a new revenue stream. We are already seeing this with new "generative credits" and AI-driven products like the Acrobat AI Assistant, which is designed to make document workflows conversational and intuitive.

2. The market recognizes this successful execution and re-rates the stock, allowing the multiple to expand from today’s pessimistic levels toward its historical average.

3. AI tools reinforce Adobe's ecosystem, making the products even more integral to creative and business workflows and deepening the company's formidable competitive advantages.

• The Bear Case: What could break this thesis?

1. The existential threat of AI proves too great. New, AI-native competitors like Midjourney are praised for their "artistic excellence", while simpler tools like Canva are winning over the non-professional market, potentially eroding Adobe's long-term user base and pricing power. If these disruptors succeed in eroding Adobe's user base and pricing power, the company’s high margins and slowing growth would collapse.

2. The low valuation is not a gift, but a "value trap" for a business whose high-growth days are over.

3. Management stumbles in its execution. The failed Figma acquisition serves as a warning, highlighting the risks of a M&A-driven strategy and the increasing regulatory scrutiny that could hinder future growth.

We have to make one thing clear - the adoption of AI and the current AI landscape is scary for adobe in some regards. Grok, Claude or Gemini are developing fast and with software in the creative space the moat is not as strong as in other sectors e.g. photmask like PLAB 0.00%↑. The risk is real, while valuation is attractive the risk/reward for us is not as safe as UNH 0.00%↑ for example. While this is priced into the current price, see above in our thesis why we think a comeback might be possible. Failing to buy Figma only hurts the most further.

🎯 6. Conclusion & Action Plan – What does this mean for my portfolio?

• Summary: Our analysis of Adobe suggests a quality company with a okay-ish moat and a fortress balance sheet, currently trading at a compelling discount due to market fears about AI disruption. The core investment thesis is that the company’s AI integration will succeed, reigniting growth and unlocking shareholder value.

• Potential: The potential for a doubling of the stock's value within 2-4 years is realistic. Our price target of $644.70 shows a clear path to significant upside.

• Recommendation: For a patient, long-term investor, the current price represents an attractive entry point to initiate a position. While the risks are real and the execution is high-stakes, the favorable risk-reward profile offers a compelling opportunity to buy a great business at a fair price, rather than a fair business at a great price.

⸻

🌰 Hazelnuts Research – The search for quality at a fair price.

Not every price drop is a risk. Some are a gift – if you understand what you're buying.

⸻

⚠️ Disclaimer

The information provided herein is for informational purposes only and also serves as a personal trading journal for the author. It represents the author's personal analysis and opinion and does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. The author is not a registered financial advisor, and readers should consult with their own financial advisors before making any investment decisions.

The content presented is based on publicly available information, sources believed to be reliable, and insights gathered through a combination of manual and automated analysis tools. While efforts are made to ensure accuracy, the author does not guarantee the completeness or timeliness of the information provided and assumes no responsibility or liability for any errors or omissions in the content or for any actions taken in reliance on the information presented.

Readers should be aware that investing involves risks, and past performance is not indicative of future results. The author may or may not hold positions in the companies mentioned. Any investment decisions made based on the information in this report are at the sole discretion of the reader, who assumes full responsibility for their own investment activities. Can you make a fitting thumbnail as a jpg.